gift in kind form

In-Kind Donations of 5000 and above. Individuals partnerships and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than 500.

Pin On Examples Printable Form Templates

The donor should seek the advice of hisher.

. Use the templates or a similar form on pages 2 and 3 to document in-kind contributions. Gift-In-Kind Transmittal Form Terms Instructions A gift-in-kind transmittal form must be completed for every gift tangible or intangible. Services like pro-bono consulting repair work.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Gift-in-Kind Form To ensure we provide a clean and healthy environment for the kids in the hospital only new toys in original packaging can be accepted. SAMPLE IN-KIND CONTRIBUTION FORMS Page 1 of 5 Instructions.

The following criteria must be met. All Major Categories Covered. The InKind Donation forms are available free to download modify and print for your church donations church administrative office Human Resources Dept etc.

If the donation is 5000 or more the department representative accepting the gift shall inform the donor that an IRS Form 8283 signed by an authorized appraiser is required by the IRS and the Foundation in addition to a copy of the appraisal. Cloud CFO Services Employee Benefit Plans Health Care Law Firms. Since the standards for recognizing contributions at their fair value were issued in 1993 NFPs have been challenged to measure the value of the myriad contributions they receive.

Please email fully completed form to give2libuarkedu or mail to the Office of Development University Libraries 365 N. Gift Services will acknowledge and receipt all donors. Some examples of in-kind donations are.

Thank you for your generous gift to Blank Childrens Hospital. In-kind donations for nonprofits can be made by individuals corporations and businesses. McIlroy Ave Fayetteville AR 72701.

An in-kind donation form is used to collect donations of goods services or volunteer time for a charity or nonprofit. 1 the donation must be. If the donation is from 500 to 499999 in addition to the above the donor andor department representative accepting the gift will need to complete IRS Form 8283 forward a copy to the Foundation and file a copy with their tax return to claim the deduction.

24 hours a day 7 days a week at your convenience. Fillable and printable In-kind Donation Form 2022. In-kind contributions are third-party donations of goods facilities or services used to meet the matching requirement for an NEA award.

Donor should go to the IRS website for the current 8283 Form and forward completed form to FAUF for signature. Please complete the form below to the best of your ability. Form 990s In-kind gifts of tangible property are reportable on the organizations annual Form 990 under the category of gifts grants contributions or membership fees Certain types of gifts including those valued at more than 25000 or art historical items or other special assets are reported on additional forms.

Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property the claimed value of which exceeds 500. For example a business may choose to donate computers to a school and declare that donation as a tax deduction. IN-KIND donations must meet the standard charitable organization rules as outlined by the Federal Accounting Standards Board FASB which includes.

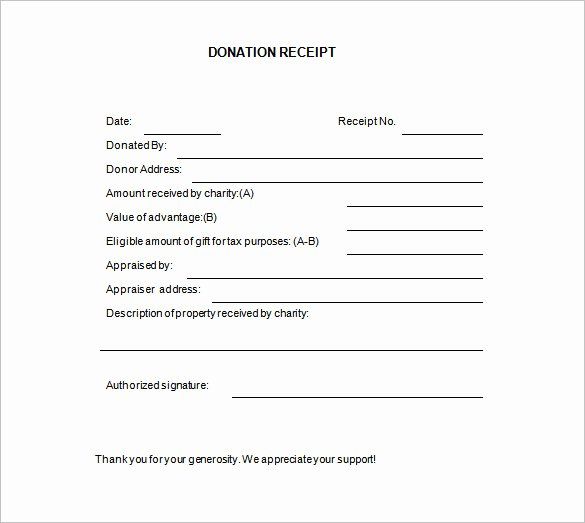

Physical items like sports equipment food office supplies. If you have any questions about our Gifts-in-Kind policy visit httpslibrariesuarkedu or contact the University Libraries Development Office at 479-575-6455. An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing furniture appliances or related items.

Current standards of the FASB require that contributed services be recognized and recorded. For in-kind contributions greater than 5000 the donor must submit an IRS form 8283 with hisher tax return for the gift to be eligible for a deduction. Hi There We are an Australian Charity organization which receives In Kind donations from US in the form of containers of medical Supplies which they ship directly to Middle east on our behalf They issued a Gift Certificate to us dated 12th Dec 2019 along with the packing list to us for supply of 5 containers of Medical supplies valued at Usd 2 millionThe actual shipment of the.

Updated April 21 2022. The form is used to provide information for an accurate depiction of the item and to prepare receipts for tax purposes. In-Kind Donations of Motor Vehicles Boats and Airplanes.

How to Claim a Receipt. Gift-in-kind donations can be delivered to the front desk at the below address Monday Friday from 800 am. Name of Organization if applicable 2.

All memorial gifts will also be acknowledge by Associate VC of Development. The completed form should be returned to. In Kind Gift Receipt.

The FAU Foundation will not provide a dollar value for this gift-in-kind. The IN-KIND DONATION RECEIPT form is 1 page long and contains. Gift in Kind Form.

Please print or type the information as legibly as possible. Your organization is not required to use these exact forms. GIFTINKIND FORM Revised 1121 Page 1 This form is for use when a noncash gift is donated to Idaho State University.

During the COVID-19 pandemic its more important than ever to organize in-kind donations to directly help those in need so boost your audience and receive more donations online with this free In. Complete Gift-in-Kind Form - the donor is required to include their full name address and list of items do-nated including the fair market value or. Gifts-in-kind with an apparent value of 5000 10000 if closely-held stock or more require that a qualified appraisal and completed IRS Form 8283 be submitted with this Gift-in-Kind Form unless the donor will not be seeking.

Use this form when an individual wants a tax receipt for an item that was donated to be in a silent auction raffle or fundraiser. Description but not value of non-cash contribution. In-Kind Donations up to 5000.

Explore Our Sample Of Gift In Kind Donation Receipt Template Receipt Template Donation Letter Letter Templates Its utilized by an individual that has donated cash or payment personal property. All gifts-in-kind must be accompanied by a fair market value estimate of the gift as determined by the donor. Reporting contributions of nonfinancial assets.

Information listed will be utilized for tax purposes. In-kind donations are non-cash gifts made to nonprofit organizations. Please refer to the gift-in-kind wish list for items currently requested.

If the University paid anything for this gift please notify the department of Planned Giving for the proper tax receipt. This controversial area is once again being addressed by watchdog agencies and state attorneys general. Consider putting a policy in place at your organization to verify proper recording of in-kind contributions when such donations occur.

Select Popular Legal Forms Packages of Any Category.

Donation Form Template Word Elegant Blank Receipt Template 20 Free Word Excel Pdf Vector Receipt Template Donation Letter Template Donation Letter

Explore Our Sample Of Gift In Kind Receipt Template Receipt Template Donation Form School Donations

Get Our Image Of Gift In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Donation Request Forms Template Beautiful Non Profit Organization Donation Request Form Organizati Donation Form Donation Request Form Donation Letter Template

Request For Contribution Or In Kind Donation Templates Donation Letter Donation Request Letters Donation Letter Template

Browse Our Example Of Non Profit Donation Receipt Template Donation Form Receipt Template Donation Request Form

Gift Of Equity Letter Template Best Of 13 Sample Gift Letters Pdf Word Letter Gifts Letter Template Word Letter Templates

Donation Form Template Free Awesome Sample Printable Donation Form Template Donation Form Donation Letter Template Word Template

Browse Our Free Charitable Donation Receipt Template Receipt Template Donation Form Non Profit Donations

Explore Our Sample Of Gift In Kind Donation Receipt Template Receipt Template Donation Letter Letter Templates

Free Donation Solicitation Letter Template Parent Booster Usa Booster Club Fundraising Lette Donation Letter Template Solicitation Letter Donation Letter

Explore Our Example Of Gift In Kind Receipt Template Receipt Template School Donations Non Profit Donations

Free Sample Donation Contribution Receipt Templates Receipt Template Preschool Newsletter Templates Donation Thank You Letter

Get Our Image Of Gift In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Pin On Printable Template Example Simple

Charitable Donation Form Template Luxury Charitable Donation Receipt Letter Template Sampl Receipt Template Printable Letter Templates Donation Letter Template

The Marvelous Charity Pledge Form Template Fresh Silent Auction Basket For Auction Bid Card Silent Auction Donations Auction Donations Donation Letter Template

Browse Our Image Of Salvation Army Donation Receipt Template Receipt Template Business Plan Template Invoice Template

Sample Free Donation Form Medical Forms Donation Form Donation Request Form Donation Letter